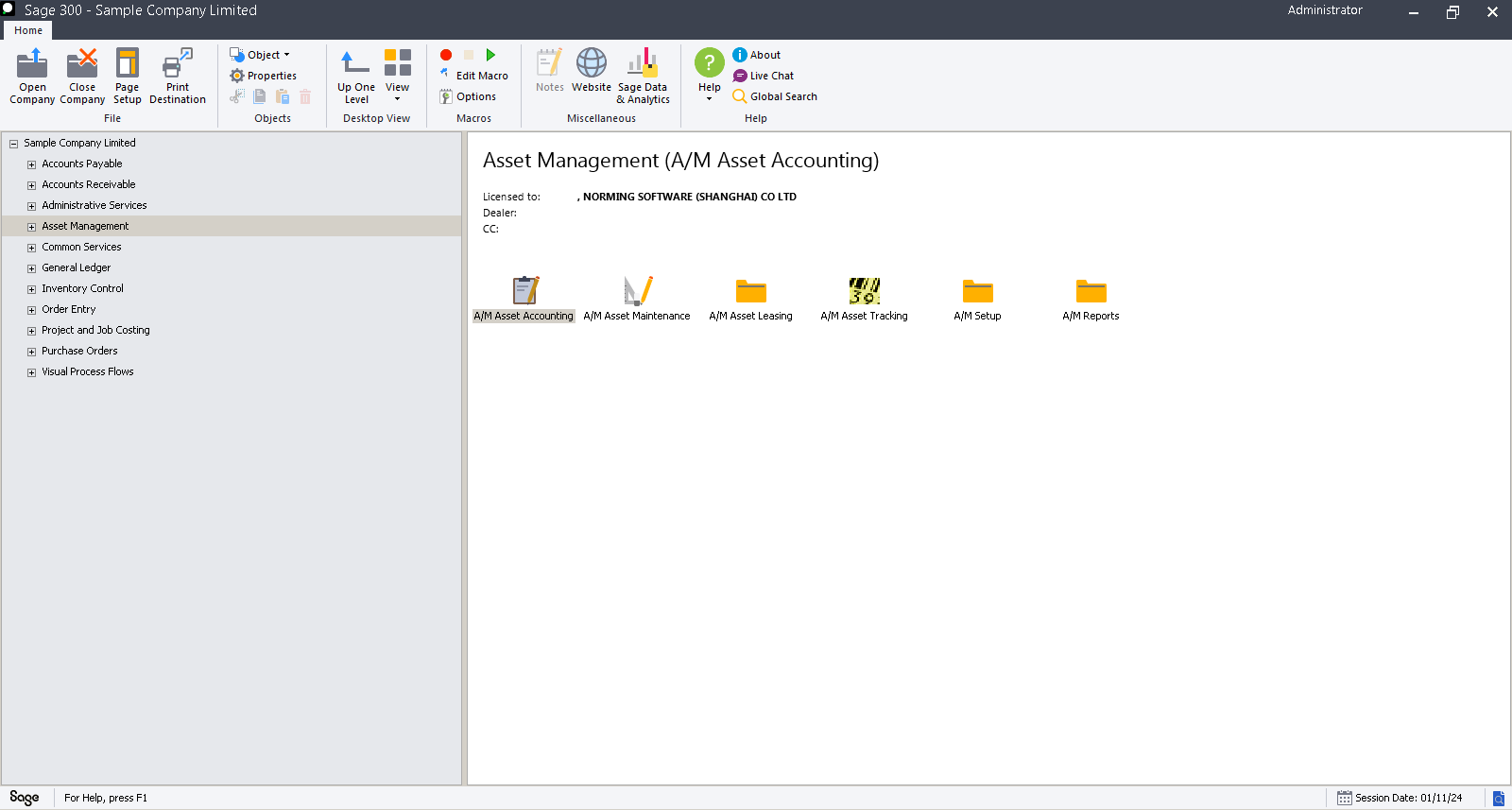

Solution Overview

Norming fixed assets provide all-in-on solution for organizations to track, manage, and maintain the lifecycle of fixed assets, from acquisition through to disposal.

With the integration seamlessly with Sage 300 modules, it ensures accuracy in reporting and compliance with tax laws and accounting standards. Whether managing a large fleet of vehicles, heavy machinery, or office equipment, Norming Asset Management helps businesses optimize the assets' operational and financial performance.

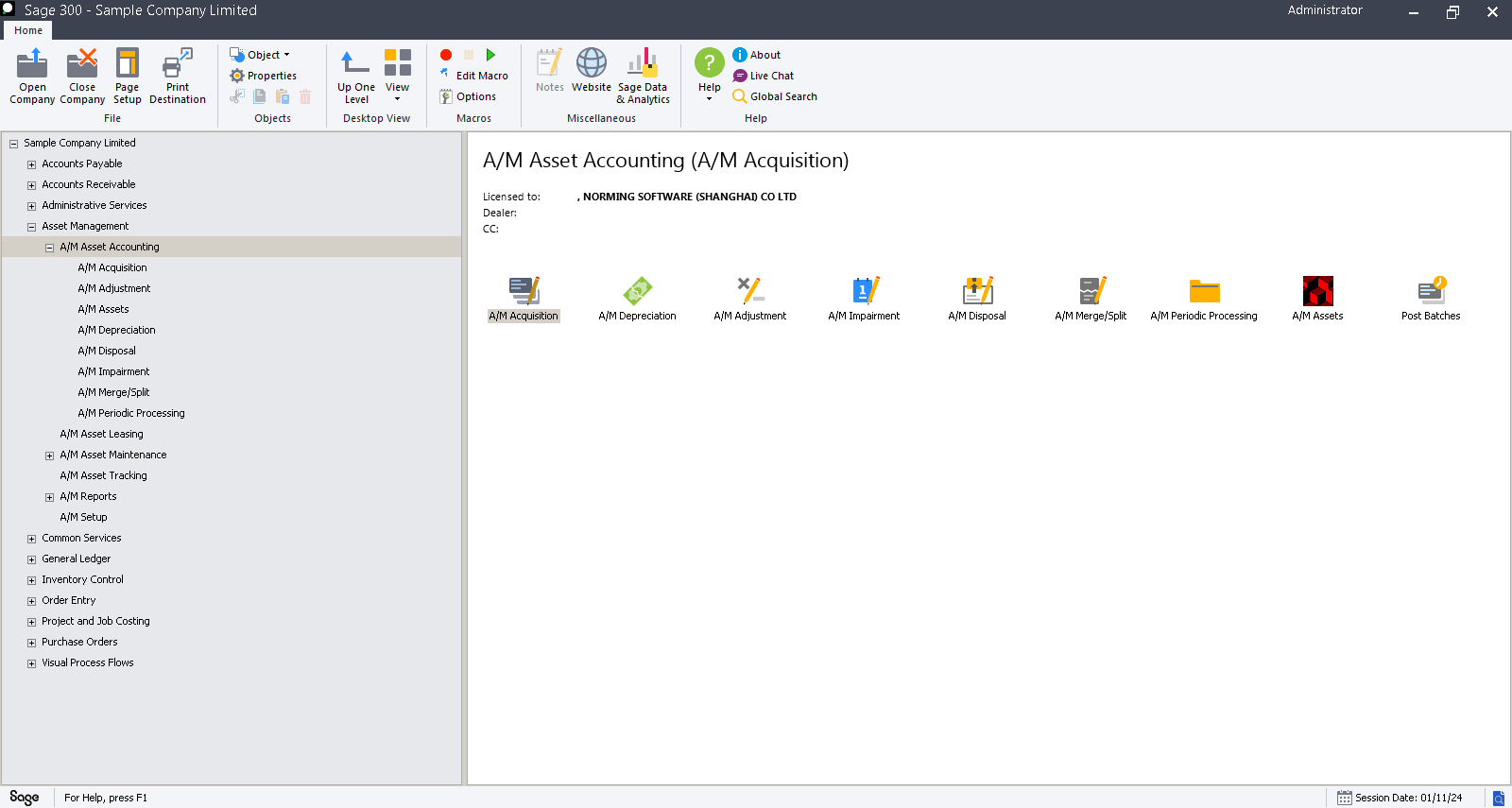

Asset Accounting

Norming Fixed Assets offers a full suite of accounting functionalities, allowing businesses to manage the financial aspects of the assets effectively. It supports various depreciation methods, automated journal entries.

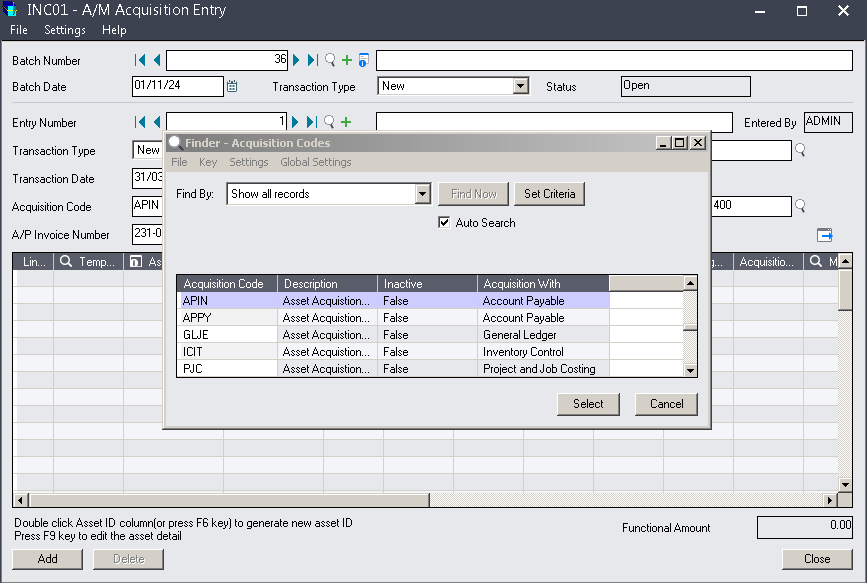

Asset Acquisition

Captures asset acquisition from Accounts Payable (AP), Purchase Order (PO), or manual entries.

Tracks asset acquisition costs, including purchase price, associated taxes, and other costs.

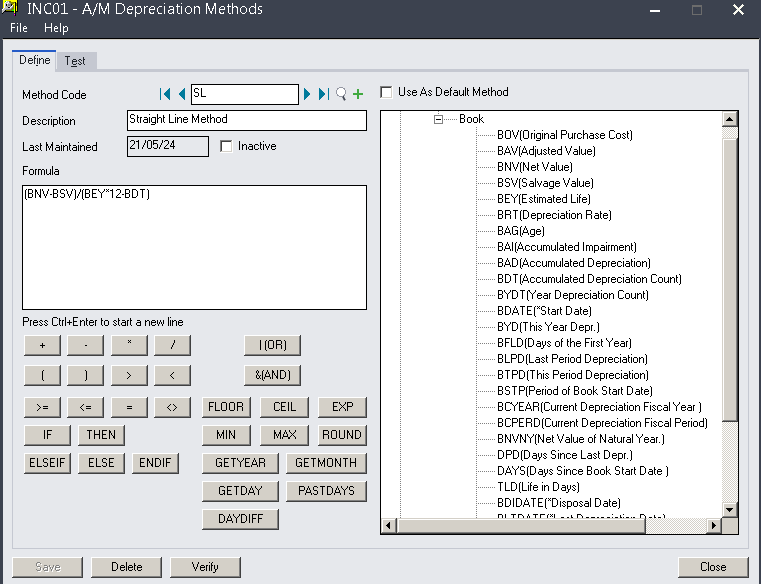

Asset Depreciation

Supports multiple depreciation methods such as Straight-Line, Declining Balance, and more.

Automatic depreciation calculations and postings to the General Ledger (GL).

Support up to 5 depreciation books to handle separate depreciation schedules for tax and accounting purposes.

Formula-based depreciation allows businesses to create and apply custom depreciation formulas based on specific business rules or financial strategies with flexibility.

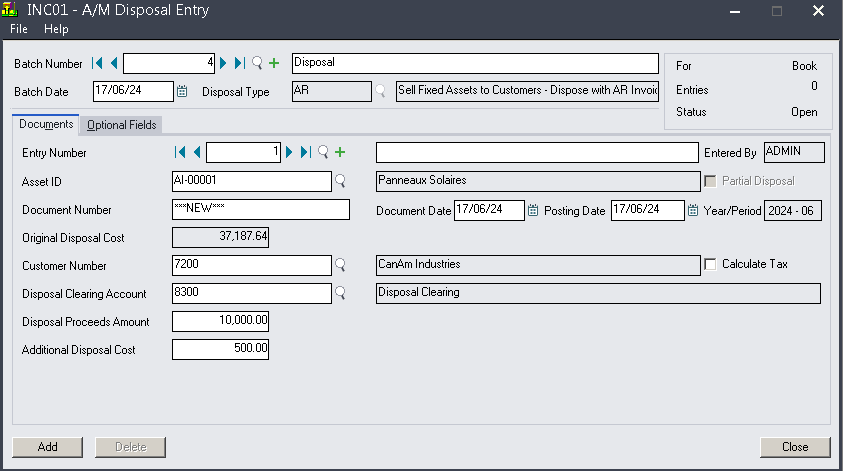

Asset Disposals

Manages full or partial asset disposals, including sales, retirements, or write-offs.

Automatically calculates gains or losses on disposal and posts them to the appropriate accounts in the General Ledger.

Tracks the sale value, cost of disposal, and proceeds (generate AR invoice) for reporting and audit purposes.

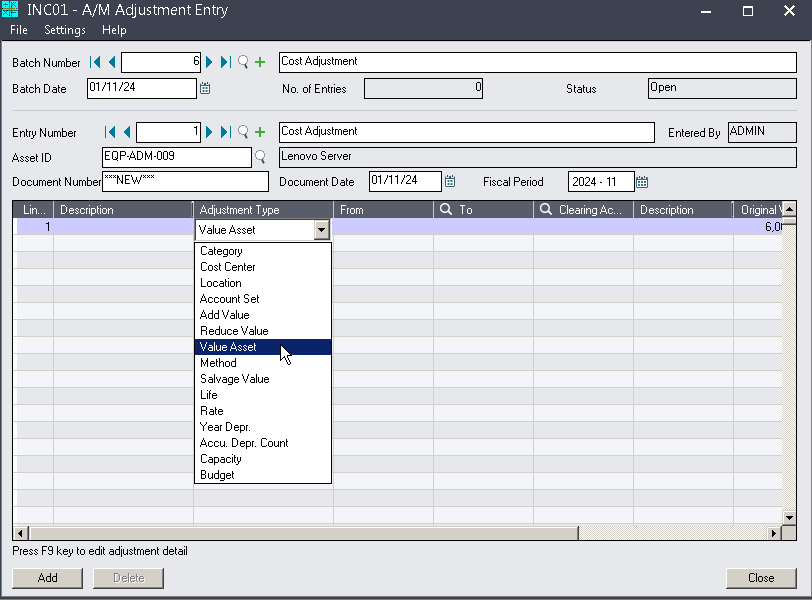

Asset Adjustment

Provide the ability to update asset-related information, such as acquisition cost, depreciation, location, or condition. It allows businesses to correct errors, update asset values, or make changes due to business activities such as improvements, repairs, or revaluations. Each adjustment is logged in Norming Asset Management with full audit trails, you can easily track when changes were made, who made them, and why. This helps ensure transparency and accountability, particularly important for audits and financial reporting.

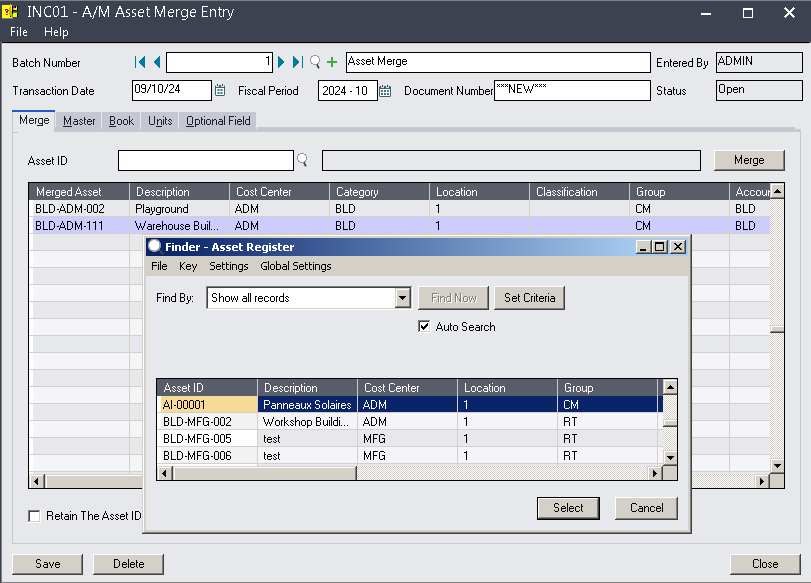

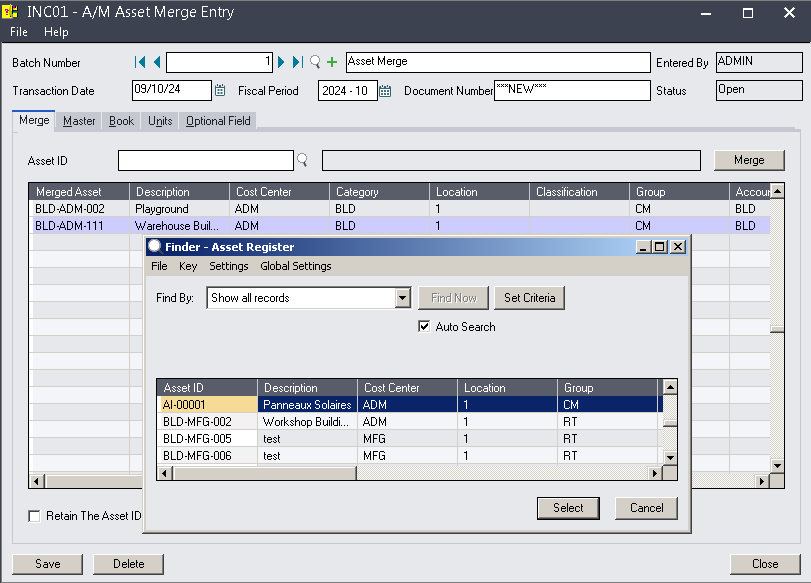

Asset Merge/Split

Combining two or more separate assets into a single, unified asset.

Splitting a single asset into two or more separate assets.

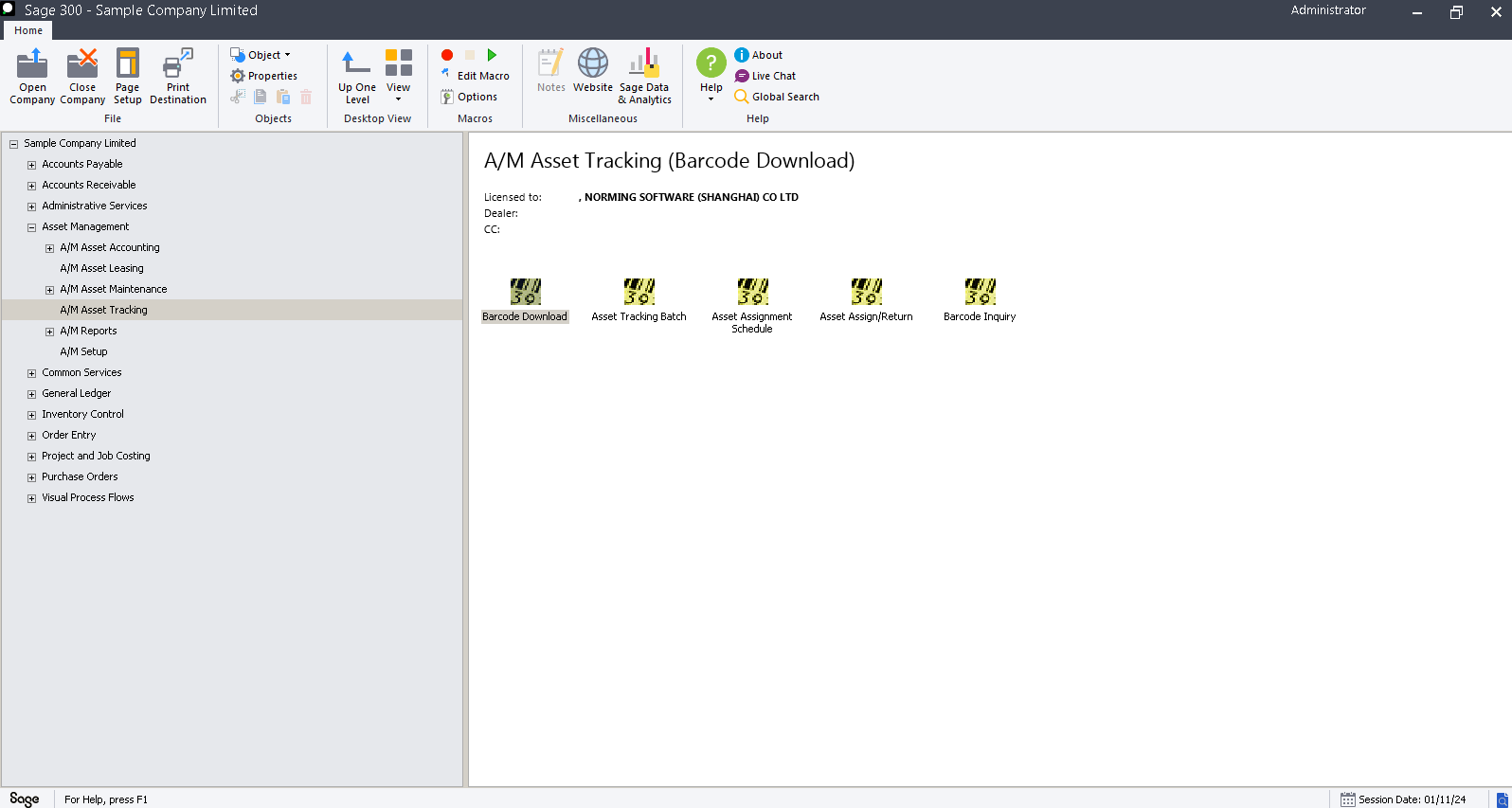

Asset Tracking

Norming Asset Tracking allows businesses to effectively manage the physical aspects of their fixed assets. This module provides a clear and detailed view of where assets are located, who is responsible for them, and their condition.

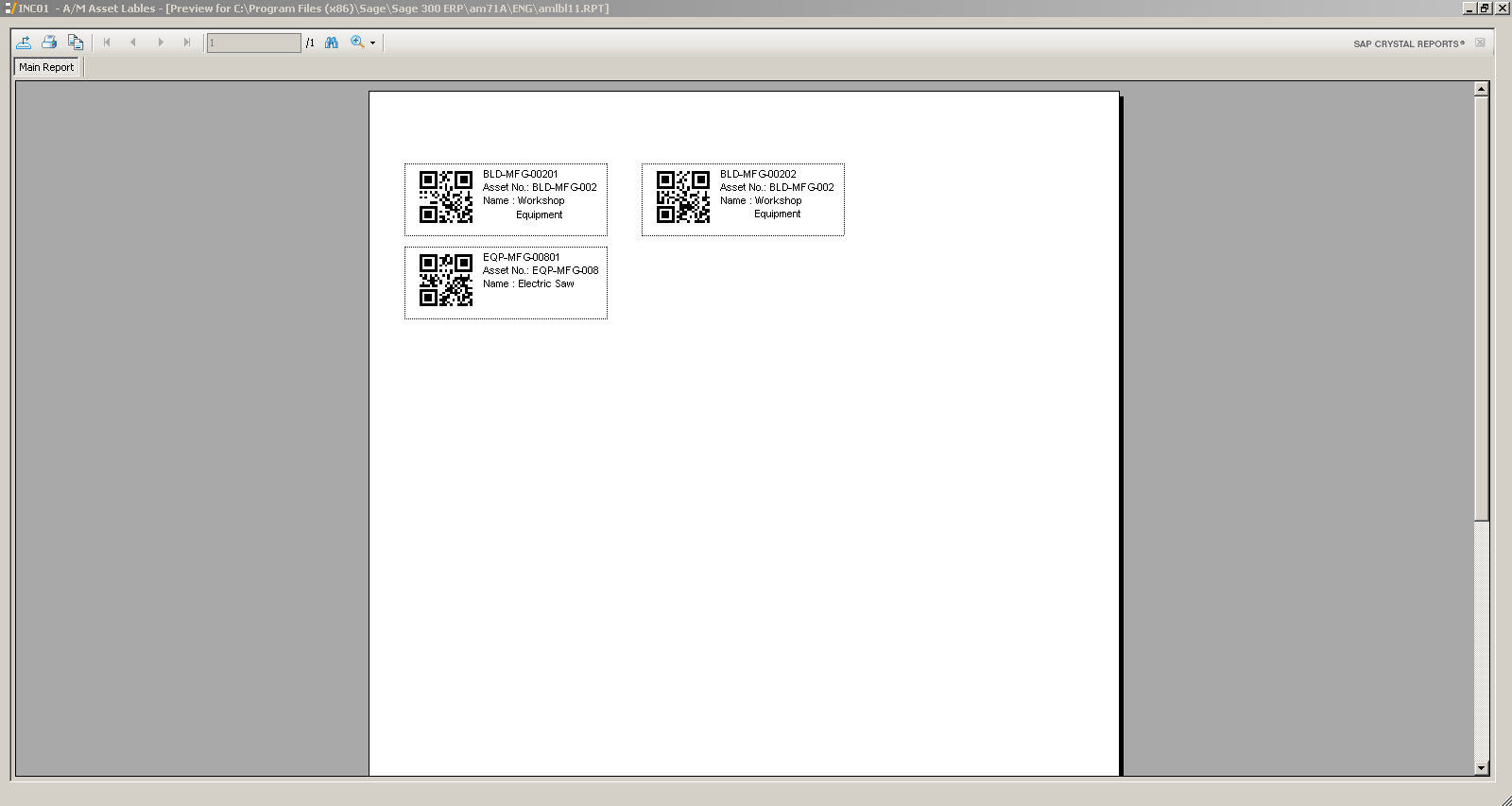

Barcode and RFID Support

Norming Asset Management supports barcode & RFID technologies. It enables businesses to label their assets with barcodes and use barcode scanners for fast and accurate asset identification and tracking. For companies with more complex asset management needs, RFID (Radio Frequency Identification) technology can be used to track assets, especially in large facilities or for assets that move frequently.

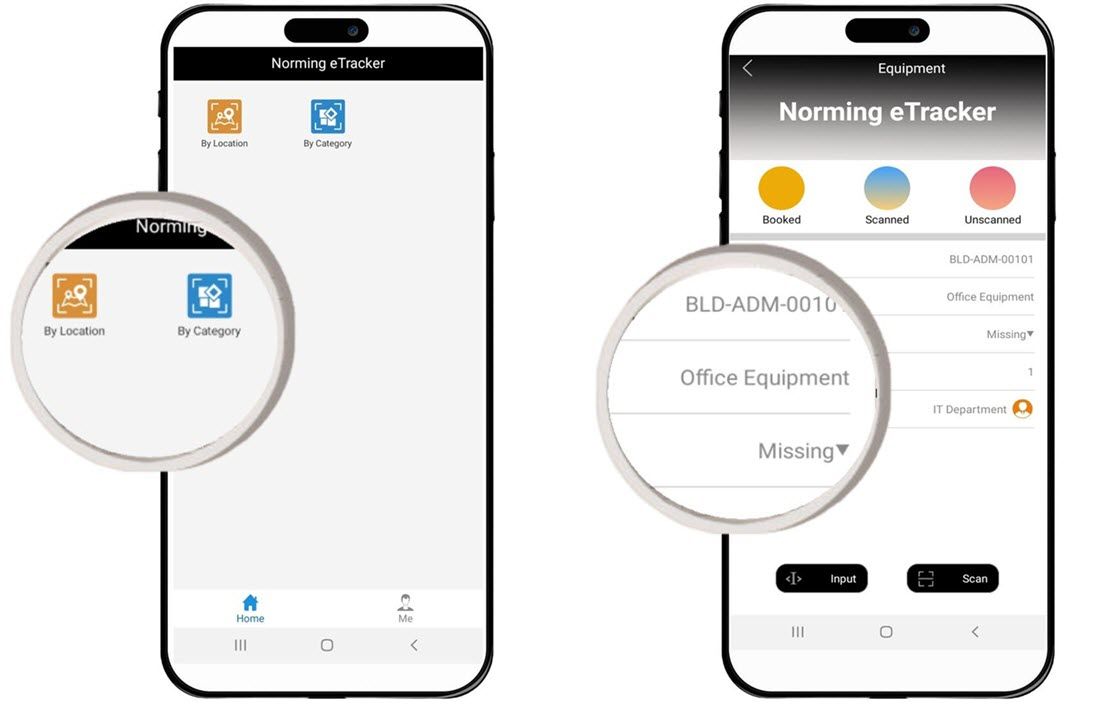

Mobile App

Norming eTracker is a mobile extension of the Norming Asset Tracking. eTracker enables organizations to conduct physical asset audits, track asset locations, and update asset information using mobile devices like smartphones or tablets. The mobile app supports barcode scanning, allowing users to easily verify, update, and manage assets while on the move.

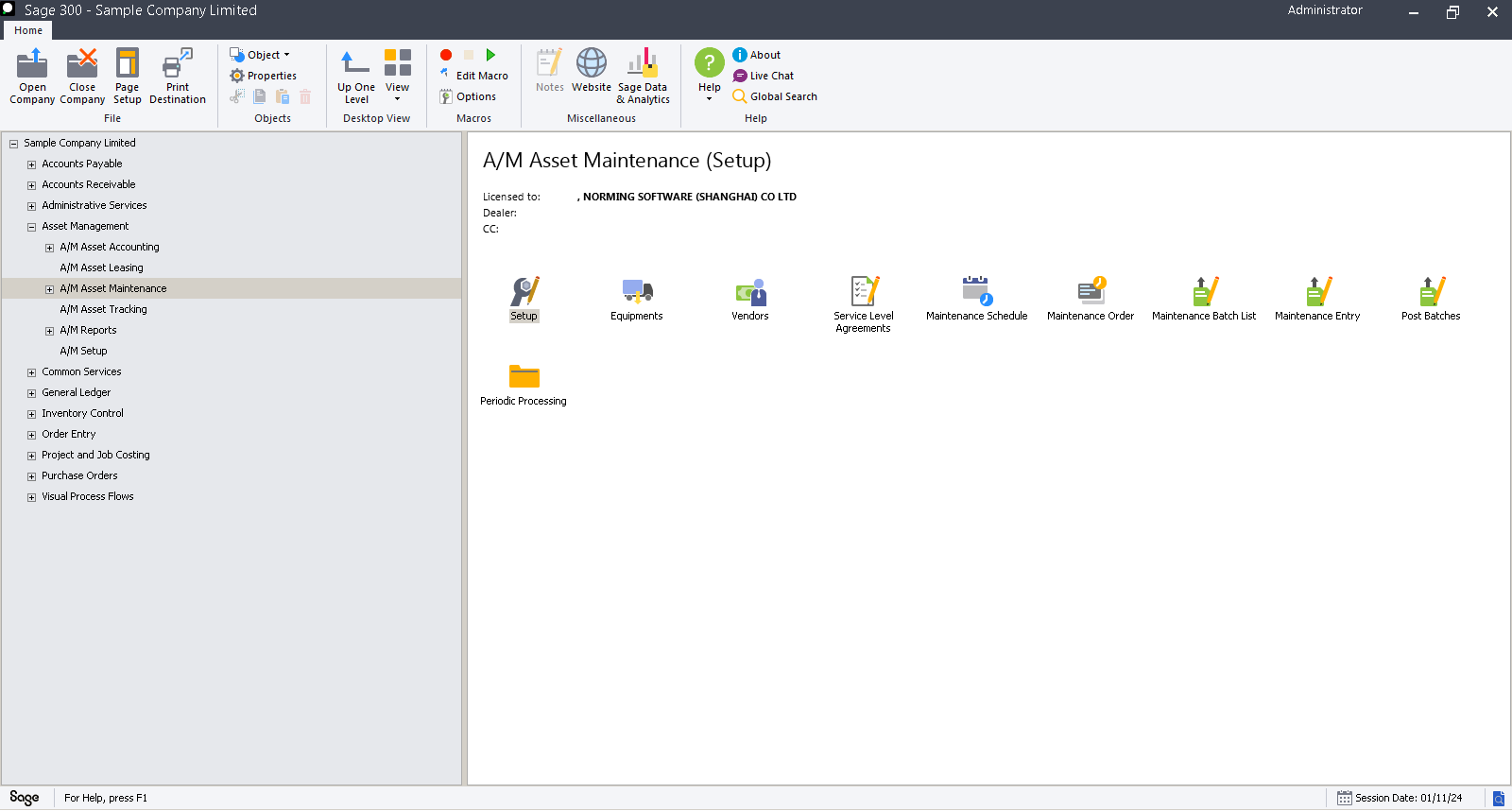

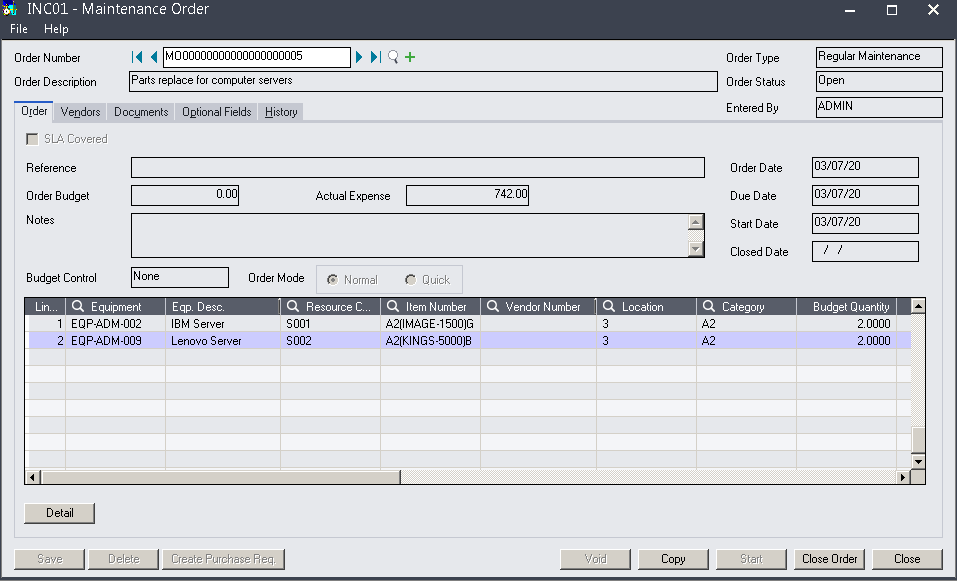

Asset Maintenance

Norming Asset Maintenance helps businesses effectively schedule, track, and manage the maintenance activities for the fixed assets. Proper asset maintenance extends the lifespan of equipment and machinery, ensures compliance with service schedules, reduces downtime, and helps businesses optimize asset performance. By automating maintenance schedules and tracking repair histories, companies can reduce unexpected breakdowns and manage operational costs more efficiently.

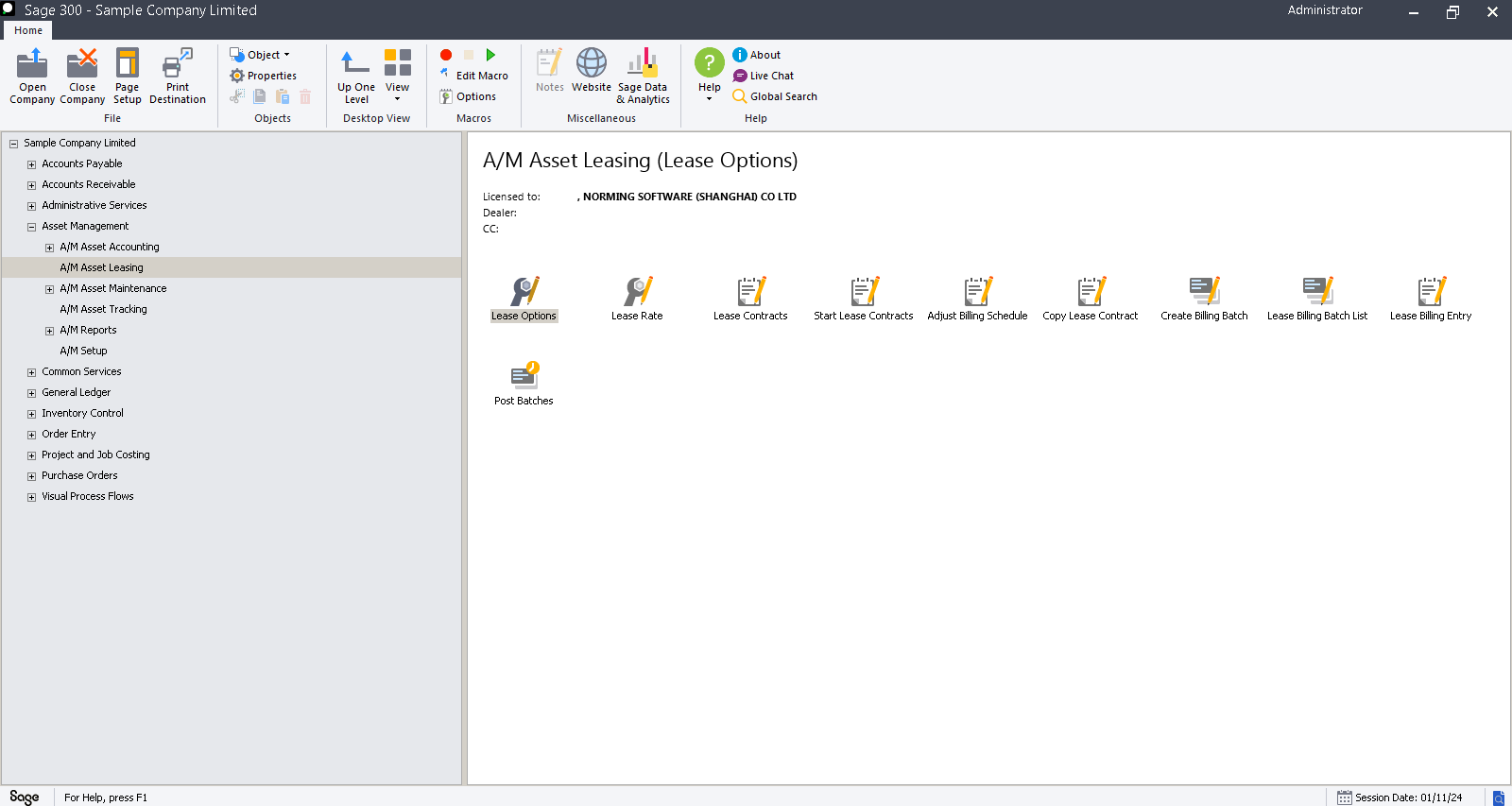

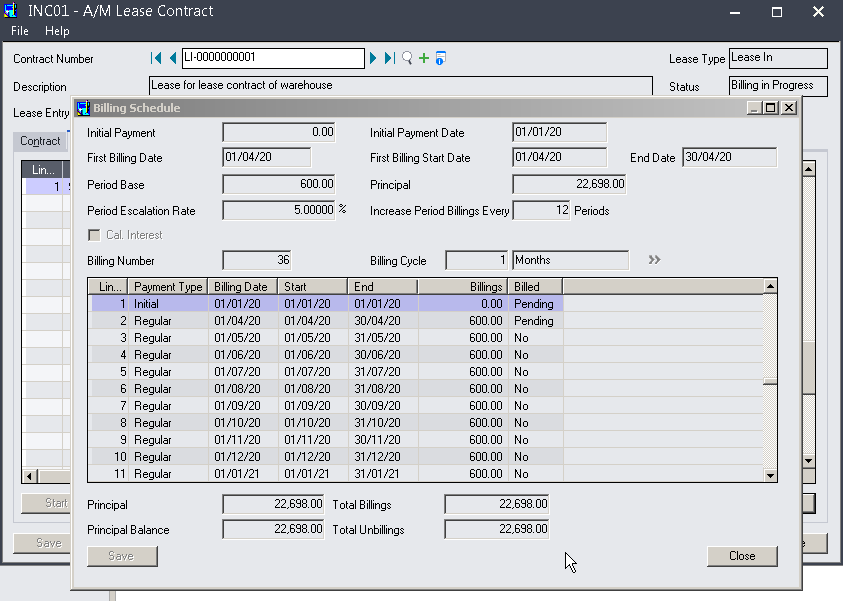

Asset Leasing

Norming Asset Leasing allows businesses to efficiently manage leased assets—whether they are leasing assets from suppliers (leased-in) or leasing assets to customers (leased-out). This functionality ensures that all leasing-related activities, such as tracking lease terms, payments, and asset depreciation, are handled accurately and in compliance with IFRS 16 accounting standard.

Integration with Accounts Payable (AP): Lease payments for leased-in assets can be seamlessly integrated with the Accounts Payable (AP) module, ensuring that all vendor payments are tracked and processed within Sage 300.

Integration with Accounts Receivable (AR): For leased-out assets, lease payment invoices are integrated with Accounts Receivable (AR) within Sage 300, allowing your business to easily bill customers and track incoming payments.